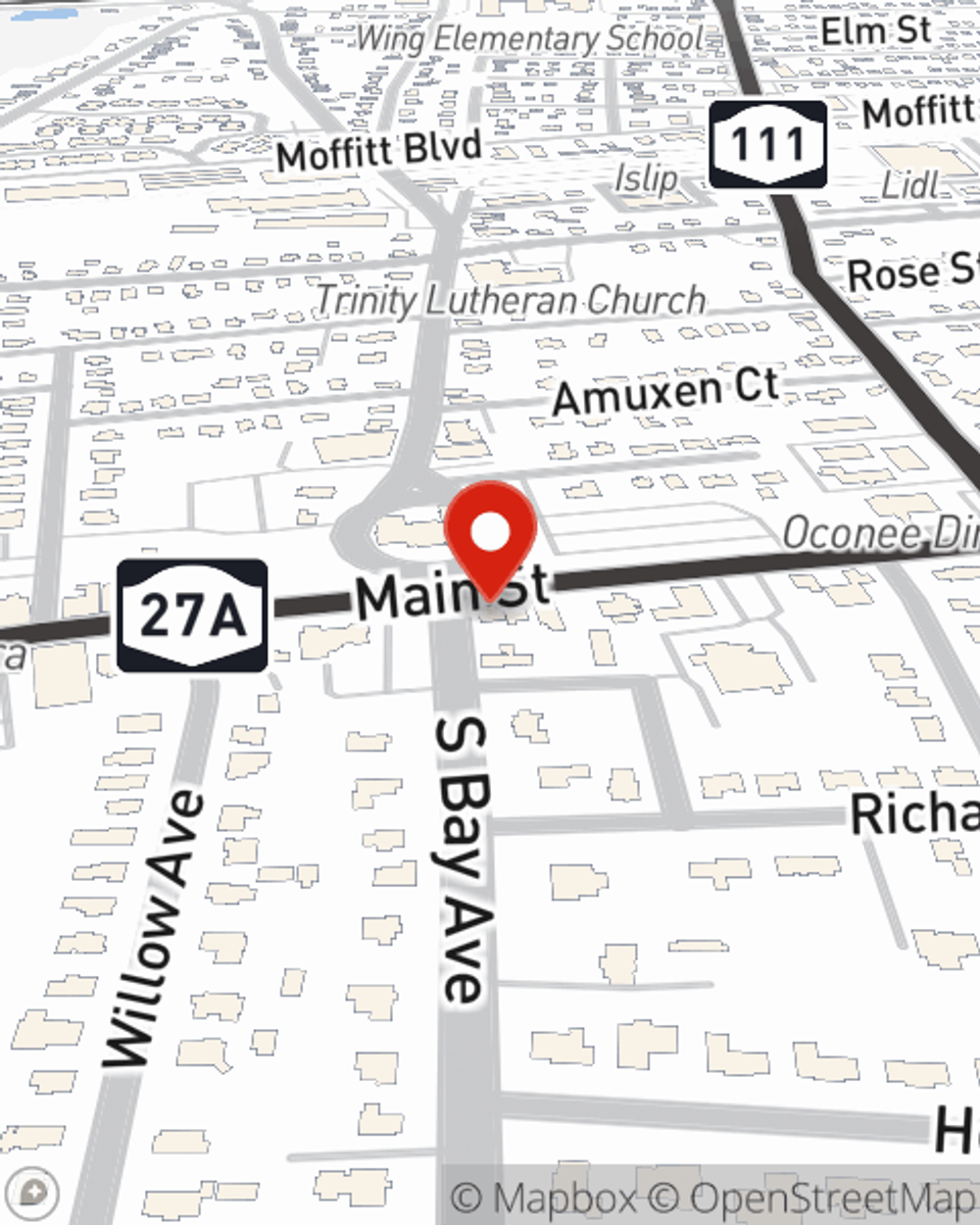

Condo Insurance in and around Islip

Unlock great condo insurance in Islip

Cover your home, wisely

- Islip, NY

- East Islip, NY

- Islip Terrace, NY

- Bay Shore, NY

- West Islip, NY

- Brightwaters, NY

- Oakdale, NY

- Hauppauge, NY

- Brentwood, NY

- Smithtown, NY

- Kings Park, NY

Your Belongings Need Protection—and So Does Your Townhome.

As with any home, it's a good idea to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has great coverage options to fit your needs.

Unlock great condo insurance in Islip

Cover your home, wisely

Safeguard Your Greatest Asset

With this protection from State Farm, you don't have to be afraid of the unpredictable happening to your condo and its contents. Agent Rich File can help inform you of all the various options for you to consider, and will assist you in building a wonderful policy that's right for you.

Want to check out the State Farm insurance options that may be right for you and your condominium? Simply reach out to agent Rich File's team today!

Have More Questions About Condo Unitowners Insurance?

Call Rich at (631) 581-7613 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.